Life insurance is the foundation of every wealth plan. Secure it now—before “what if” becomes “why didn’t I?

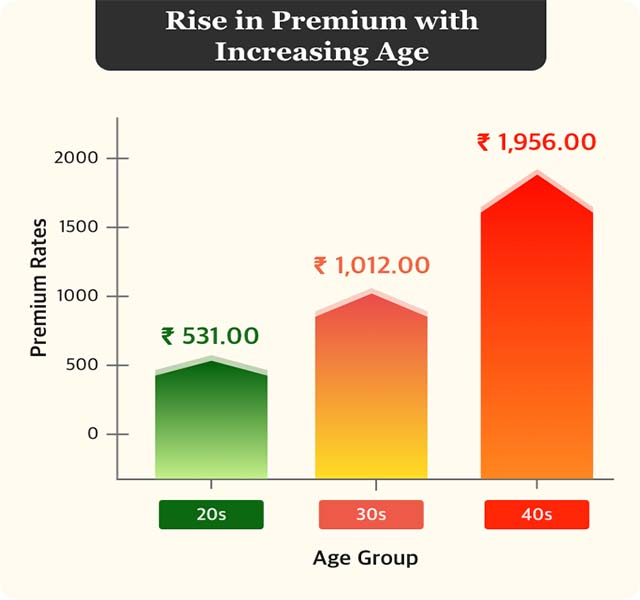

Every year you delay, premiums rise 4-8 %. Lock today’s rate for the next 30 years—even if your health changes tomorrow

Get Quote NowCompare top insurers, term vs ULIP clarity.

Start My Protection PlanYearly check-ups, claims support, and WhatsApp reassurance.

Start My Protection PlanNathShield

| Advantage | Why It Matters |

|---|---|

| Needs-Based Cover Calculation | We factor income, liabilities, children’s education, and lifestyle—no random multipliers. |

| Term + Riders Strategy | Critical-illness and waiver riders plug hidden gaps most agents ignore. |

| Annual Policy Review | Life evolves; coverage keeps pace—without policy-shopping hassles. |

Feedback

Mythbusting

Insurance is an investment

It’s protection; invest surplus in mutual funds.

Company cover is enough

Job change = cover gone. Personal term keeps you safe.

I’m young; I’ll buy later.

Premiums never get cheaper than today.

FAQ